Executive Summary Malfunction Insurance Market :

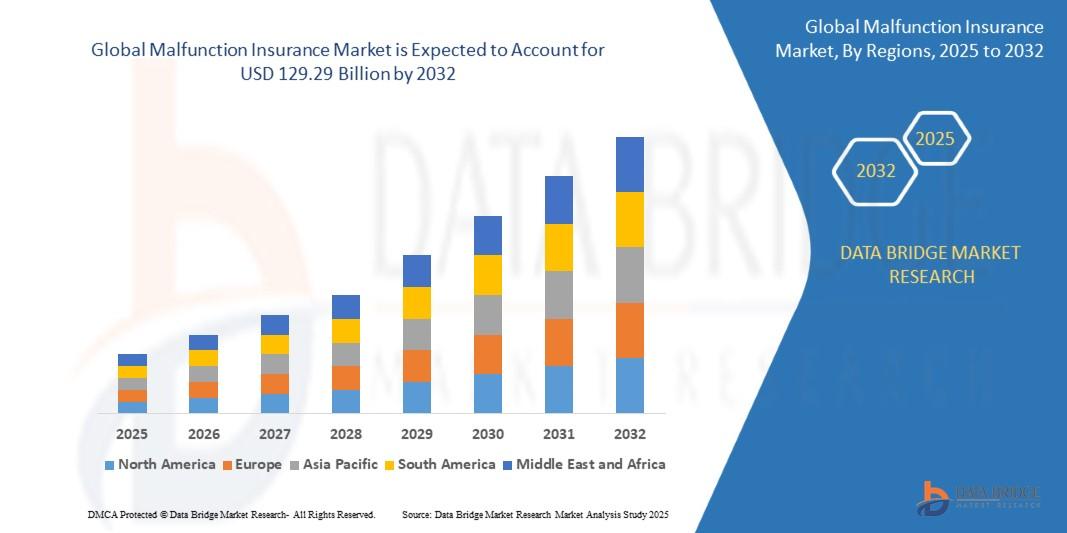

The global malfunction insurance market size was valued at USD 55.30 billion in 2024 and is projected to reach USD 129.29 billion by 2032, with a CAGR of 11.20% during the forecast period of 2025 to 2032. In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis.

This Malfunction Insurance Market report provides key statistics on the market status of global and regional manufacturers and is a valuable source of guidance and direction for companies and individuals interested in the industry. The market research report is a resource, which provides current as well as upcoming technical and financial details of the industry to 2025. This market report also contains market drivers and market restraints for industry that are derived from SWOT analysis, and also shows what all the recent developments, product launches, joint ventures, mergers and acquisitions by the several key players and brands that are driving the market are by systemic company profiles.

Malfunction Insurance Market research report also examines competitive companies and manufacturers in the global market. Their moves like product launches, joint ventures, mergers and acquisitions and the respective effect on the sales, import, export, revenue and CAGR values have been studied completely in the report. The Malfunction Insurance Market report comprises of primary, secondary and advanced information about the global market with respect to status, trends, size, share, growth, and segments in the forecasted period of 2018 - 2025. Malfunction Insurance Market research study lends a hand to the purchaser in comprehending the various drivers and restraints with their effects on the market during the forecast period.

Discover the latest trends, growth opportunities, and strategic insights in our comprehensive Malfunction Insurance Market report. Download Full Report: https://www.databridgemarketresearch.com/reports/global-malfunction-insurance-market

Malfunction Insurance Market Overview

**Segments**

- **Type:** The malfunction insurance market can be segmented into product malfunction insurance, service malfunction insurance, and combination malfunction insurance. Product malfunction insurance covers the costs associated with defects or malfunctions in physical products. Service malfunction insurance provides coverage for errors or issues in services provided by a company. Combination malfunction insurance offers a comprehensive package that includes coverage for both products and services.

- **End-User:** The market can also be segmented based on end-users such as manufacturing industries, healthcare sectors, automotive industry, consumer electronics, and others. Each sector has specific needs when it comes to malfunction insurance, and companies within these sectors look for tailored insurance solutions to mitigate risks associated with malfunctions.

- **Distribution Channel:** The distribution channels in the malfunction insurance market include insurance brokers, online sales, direct sales, and others. Insurance brokers play a crucial role in connecting clients with insurance providers and offering customized solutions. Online sales have gained traction due to the convenience and accessibility they offer to customers in purchasing malfunction insurance policies.

**Market Players**

- **Allianz Group:** Allianz is a leading player in the global malfunction insurance market, offering a wide range of insurance products tailored to meet the needs of various industries. The company's expertise in risk assessment and management makes it a preferred choice for businesses looking for comprehensive malfunction insurance coverage.

- **AXA Group:** AXA is another key player in the malfunction insurance market, known for its innovative insurance solutions and global presence. The company's focus on technology and digitalization has helped it stay competitive in the market and cater to the evolving needs of customers in different sectors.

- **Zurich Insurance Group:** Zurich Insurance Group is a prominent player in the malfunction insurance market, offering specialized insurance products for businesses facing risks related to product or service malfunctions. The company's solid financial strength and risk management strategies make it a reliable partner for companies seeking malfunction insurance coverage.

- **Chubb Limited:** Chubb Limited is a well-known insurer in the malfunction insurance market, providing customized insurance solutions for businesses across various industries. The company's extensive experience in underwriting complex risks and claims management sets it apart in the market as a trusted provider of malfunction insurance.

The global malfunction insurance market is expected to witness significant growth in the coming years, driven by the increasing awareness among businesses about the importance of mitigating risks associated with product and service malfunctions. Rising demand for customized insurance solutions, technological advancements in risk assessment, and the growing focus on preventive measures to avoid malfunctions are factors that will shape the future of the market.

The malfunction insurance market is experiencing a notable shift towards customization and specialization to cater to the diverse needs of different industries. Companies are increasingly recognizing the importance of proactive risk management to safeguard against potential financial repercussions resulting from product or service malfunctions. This shift is driving market players to develop innovative insurance solutions that not only provide coverage but also address the specific requirements of various business sectors. Moreover, the adoption of advanced technologies in risk assessment and underwriting processes is enhancing the efficiency and accuracy of malfunction insurance offerings, thereby boosting the market growth.

One emerging trend in the malfunction insurance market is the integration of Internet of Things (IoT) technology to enable real-time monitoring and data analysis of products and services. IoT sensors embedded in products allow for continuous performance tracking, which can help in identifying potential malfunctions before they escalate into larger issues. This proactive approach not only minimizes the financial impact of malfunctions but also enhances customer satisfaction by ensuring uninterrupted service delivery. Market players who leverage IoT technology in their malfunction insurance offerings are likely to gain a competitive edge by providing value-added services to their clients.

Another key development in the malfunction insurance market is the increasing focus on sustainability and environmental responsibility. As businesses strive to minimize their carbon footprint and adhere to stringent regulations, the demand for insurance solutions that cover environmental damages resulting from malfunctions is on the rise. Companies operating in environmentally sensitive industries such as manufacturing and automotive are looking for comprehensive malfunction insurance policies that address both financial risks and environmental liabilities. Market players that offer green malfunction insurance products tailored to these specific needs stand to capitalize on this growing trend and expand their market presence.

Furthermore, the COVID-19 pandemic has highlighted the importance of business continuity planning and risk management in the face of unforeseen disruptions. The pandemic-induced supply chain challenges and operational disruptions have underscored the need for robust malfunction insurance coverage to safeguard businesses against unforeseen events. Market players that offer comprehensive coverage against epidemic-related malfunctions, such as supply chain disruptions and service delays, are likely to witness increased demand as companies prioritize resilience and risk mitigation strategies in their operations.

In conclusion, the malfunction insurance market is evolving rapidly to meet the changing needs of businesses across various industries. Customized insurance solutions, technological advancements, sustainable practices, and resilience against unforeseen disruptions are key drivers shaping the future of the market. Companies that adapt to these trends and offer innovative malfunction insurance products tailored to industry-specific requirements will be well-positioned to capitalize on the lucrative opportunities presented by the evolving market landscape.The malfunction insurance market is witnessing a transformative shift towards customization and specialization to cater to the unique needs of diverse industries. Companies are increasingly acknowledging the significance of proactive risk management to shield themselves from potential financial repercussions arising from product or service malfunctions. This paradigm shift is compelling market players to innovate insurance solutions that not only offer coverage but also address the distinct requirements of various business sectors. Moreover, the integration of advanced technologies in risk assessment and underwriting processes is amplifying the efficiency and precision of malfunction insurance offerings, thereby propelling market expansion.

One notable trend reshaping the malfunction insurance landscape is the integration of Internet of Things (IoT) technology to facilitate real-time monitoring and data analysis of products and services. By embedding IoT sensors in products, continuous performance tracking becomes achievable, aiding in the early identification of potential malfunctions before they snowball into major issues. This proactive methodology not only minimizes the financial ramifications of malfunctions but also enhances customer contentment by ensuring uninterrupted service delivery. Market players leveraging IoT technology in their malfunction insurance portfolio are poised to gain a competitive advantage by delivering value-added services to their clientele.

Another significant development in the malfunction insurance sector centers around the escalating emphasis on sustainability and environmental stewardship. With businesses striving to curtail their carbon footprint and adhere to stringent regulations, the demand for insurance solutions encompassing environmental damages resulting from malfunctions is on a definite upswing. Industries such as manufacturing and automotive, operating in environmentally sensitive domains, are actively seeking comprehensive malfunction insurance policies that encapsulate financial risks alongside environmental liabilities. Market participants offering eco-friendly malfunction insurance products tailored to these specific requisites are poised to harness the burgeoning trend and broaden their market footprint.

Moreover, the disruptions wrought by the COVID-19 pandemic have underscored the importance of business continuity planning and risk management in the face of unforeseen contingencies. The supply chain bottlenecks and operational interruptions stemming from the pandemic have underscored the criticality of robust malfunction insurance coverage in shielding businesses against unanticipated events. Market entities furnishing comprehensive coverage against epidemic-related malfunctions, such as supply chain disruptions and service impediments, are likely to witness heightened demand as enterprises prioritize resilience and risk mitigation strategies in their operations.

In essence, the malfunction insurance realm is swiftly evolving to align with the evolving requirements of businesses operating in diverse sectors. Tailored insurance solutions, technological advancements, sustainability initiatives, and resilience against unforeseen disruptions are pivotal factors delineating the trajectory of the market. Companies that adeptly adapt to these trends and proffer innovative malfunction insurance products customized to industry-specific exigencies are primed to capitalize on the lucrative opportunities stemming from the dynamic market landscape.

The Malfunction Insurance Market is highly fragmented, featuring intense competition among both global and regional players striving for market share. To explore how global trends are shaping the future of the top 10 companies in the keyword market.

Learn More Now: https://www.databridgemarketresearch.com/reports/global-malfunction-insurance-market/companies

DBMR Nucleus: Powering Insights, Strategy & Growth

DBMR Nucleus is a dynamic, AI-powered business intelligence platform designed to revolutionize the way organizations access and interpret market data. Developed by Data Bridge Market Research, Nucleus integrates cutting-edge analytics with intuitive dashboards to deliver real-time insights across industries. From tracking market trends and competitive landscapes to uncovering growth opportunities, the platform enables strategic decision-making backed by data-driven evidence. Whether you're a startup or an enterprise, DBMR Nucleus equips you with the tools to stay ahead of the curve and fuel long-term success.

What insights readers can gather from the Malfunction Insurance Market report?

- Learn the behavior pattern of every Malfunction Insurance Market-product launches, expansions, collaborations and acquisitions in the market currently.

- Examine and study the progress outlook of the global Malfunction Insurance Marketlandscape, which includes, revenue, production & consumption and historical & forecast.

- Understand important drivers, restraints, opportunities and trends (DROT Analysis).

- Important trends, such as carbon footprint, R&D developments, prototype technologies, and globalization.

Browse More Reports:

Global Gas Hydrates Market

Global Gas Filtration Media Market

Global Fruit Sorting Machinery Market

Global Frozen Poultry and Meat Market

Global Frasier Syndrome Market

Global Frac Sand Market

Global Food Savory Ingredients Market

Global Food Sanitization Equipment Market

Global Folate Deficiency Anemia Drug Market

Global Focal Segmental Glomerulosclerosis Market

Global Foaming Creamer Market

Global Foam Insulation Market

Global Fluid Dispensing Equipment Market

Global Flu Treatment Market

Global Flow Chemistry Market

Global Flexible Pipe Market

Global Flexible Pet Care Packaging Market

Global Flexible Display Market

Global Flaxseed Market

Global Flax Milk Market

About Data Bridge Market Research:

An absolute way to forecast what the future holds is to comprehend the trend today!

Data Bridge Market Research set forth itself as an unconventional and neoteric market research and consulting firm with an unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market. Data Bridge endeavors to provide appropriate solutions to the complex business challenges and initiates an effortless decision-making process. Data Bridge is an aftermath of sheer wisdom and experience which was formulated and framed in the year 2015 in Pune.

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC : +653 1251 975

Email:- corporatesales@databridgemarketresearch.com

Tag

Malfunction Insurance Market Size, Malfunction Insurance Market Share, Malfunction Insurance Market Trend, Malfunction Insurance Market Analysis, Malfunction Insurance Market Report, Malfunction Insurance Market Growth, Latest Developments in Malfunction Insurance Market, Malfunction Insurance Market Industry Analysis, Malfunction Insurance Market Key Player, Malfunction Insurance Market Demand Analysis